Vision

World-class communities through consistent social sector leadership.

Mission

To provide superior leadership tools and resources so nonprofit leaders and board members can make viable decisions that move organizations forward to a sustainable and vibrant future.

Nonprofit Consulting Services

Bringing Success to Your Nonprofit Organization

805 Focus!

You can be featured on 805 Focus!

If you would like to be interviewed on 805 Focus! and be featured in Newshawk Magazine, please complete the form. I usually respond within 24 hours.

805 Focus! is aired on TBSB. multiple times throughout a 90-day cycle.

Kinecting Dots…

You can be featured in Noozhawk Digital Magazine

If you would like your story to be told in Noozhawk Magazine, please let me know. I usually respond within 24 hours.

Cynder Sinclair, Noozhawk Columnist

— Dr. Cynder Sinclair is a consultant to nonprofits and founder and CEO of Nonprofit Kinect. She has been successfully leading nonprofits for 30 years and holds a doctorate in organizational management. To read her blog, click here. To read her previous articles, click here.

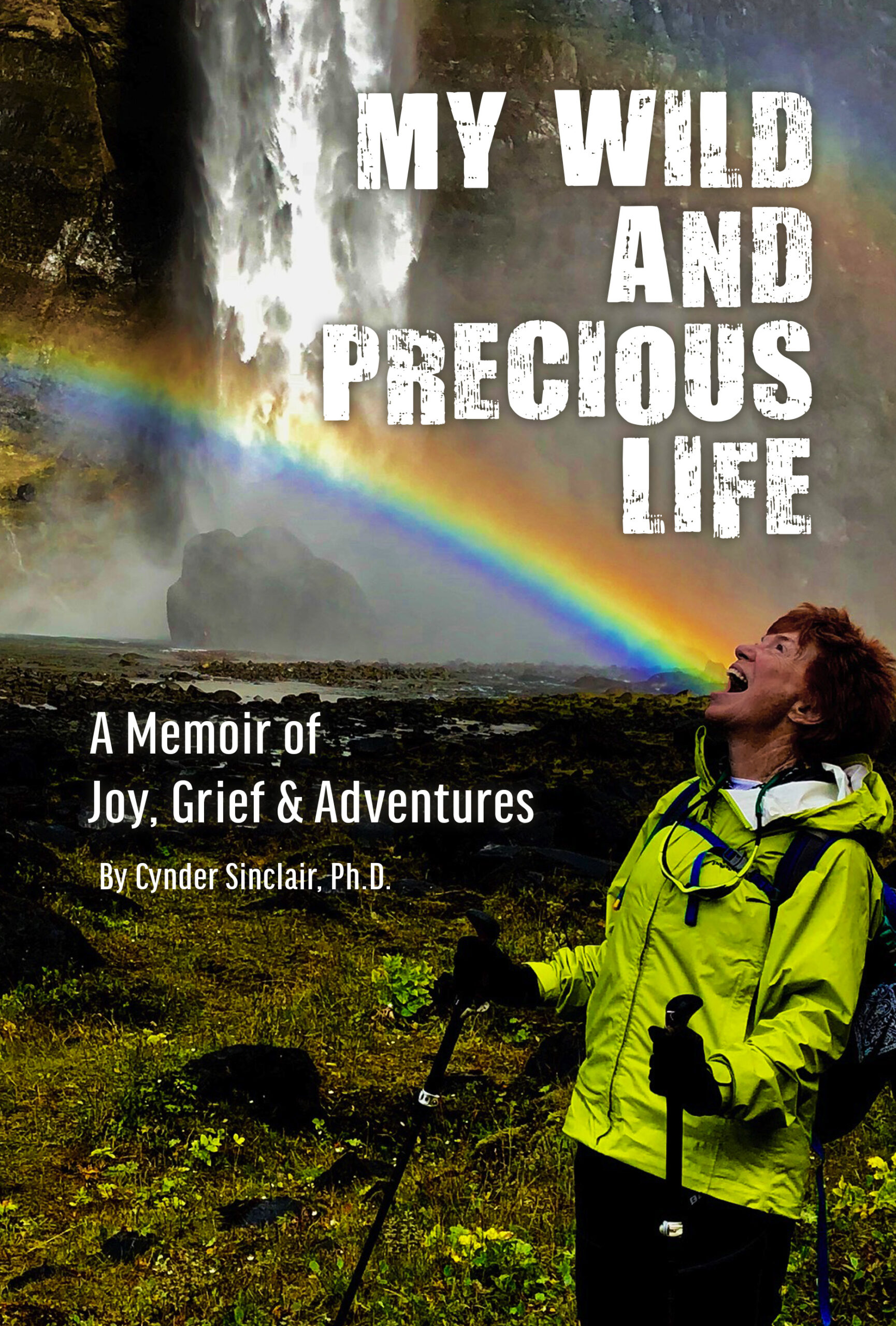

My Wild and Precious Life

A Memoir of Joy, Grief and Adventures

Order your own copy of my wild and precious memoirs highlighting 75 years of stories—some hilarious, some thought-provoking and some downright amazing. You will read about nonprofits I founded and led, travels around the world, how DNA helped find my father and the grief of losing my son. You will be amazed at how I bamboozled the FBI, was almost arrested by Homeland Security and raised five children starting at age 19.

~ Dr. Cynder Sinclair

Our Latest Blogs

Richard Haass Elaborates on Things That Matter

Over 500 people filled the Santa Barbara Hilton Ballroom a rainy March morning, each one still a little sleepy from rising so early to get a good...

How Your Nonprofit Can Avoid Embezzlement in Your Nonprofit and What to do if it Happens

What are the chances of someone embezzling funds from your nonprofit? Most board and staff members think the possibility is remote for their...

10 Tactics to Keep Your Meeting on Track

Discover how to keep your meetings on track. Read this Harvard Business Review article from January 5, 2022 by Joel Schwartzberg Too many meeting...